My paycheck after taxes

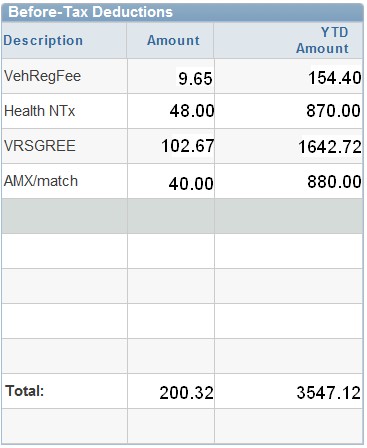

Add the employees pay information. For instance a person who lives paycheck-to-paycheck can calculate how much they will have available to pay next months rent and expenses by using their take-home-paycheck amount.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

18 rows Your hourly wage or annual salary cant give a perfect indication of how much youll see in your.

. Your average tax rate is 217 and your marginal tax rate is 360. This lets you pay your taxes gradually throughout the year rather than. Multiple factors affect your withholdings.

We make taxes just a little easier. Per a new report an unnamed dispatch assistant at a cold meats processor in Chile Consorcio Industrial de Alimentos normally. If you make 202620 a year living in the region of New York USA you will be taxed 54981.

Complete a new Form W-4P Withholding Certificate for Pension or. Without the help of a paycheck calculator its tricky to figure out what your take-home pay will be after taxes and other monies are withheld. To add up your weekly paycheck first calculate your hourly wage by dividing your annual salary by 52.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. This number is the gross pay per pay period. SmartAssets Washington paycheck calculator shows your hourly and salary income after federal state and local taxes.

Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it to your employer. Your employer withholds 145 of your gross income from your paycheck. Our calculators are easy to use and allow you to punch in numbers and get real results.

Your average tax rate is 2056 and your marginal tax. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms. Your marital and filing status is a big part of it.

Their name and the state where they live. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. This will help the tool calculate some of the employees local taxes.

Subtract any deductions and. This marginal tax rate means that your immediate additional income will be taxed at this rate. Calculate your paycheck in 5 steps Step 1 Filing status.

For example you can have an extra 25 in taxes taken out of each paycheck. A Man Received 300 Times His Salary. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

This money goes to the IRS who will put it toward your annual income taxes. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local. Enter your info to see your take home pay.

Subtract any deductions and. There are no income limits for. Your employer pays an additional 145 the employer part of the Medicare tax.

This includes just two items. For instance an increase of. When calculating your take-home.

Step 2 Adjusted. Your marital status and whether you have any dependent will determine your filing status. Since our free online calculators arent associated.

This number is the gross pay per pay period. One option that you have is to ask your employer to withhold an additional dollar amount from your paychecks. For starters all Pennsylvania employers will.

New York Income Tax Calculator 2021. There may also be contributions toward insurance coverage retirement funds and other optional contributions all of which can lower your final paycheck. Next divide this number from the annual salary.

Free salary hourly and more paycheck calculators.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Taxes Federal State Local Withholding H R Block

Here S How Much Money You Take Home From A 75 000 Salary

Check Your Paycheck News Congressman Daniel Webster

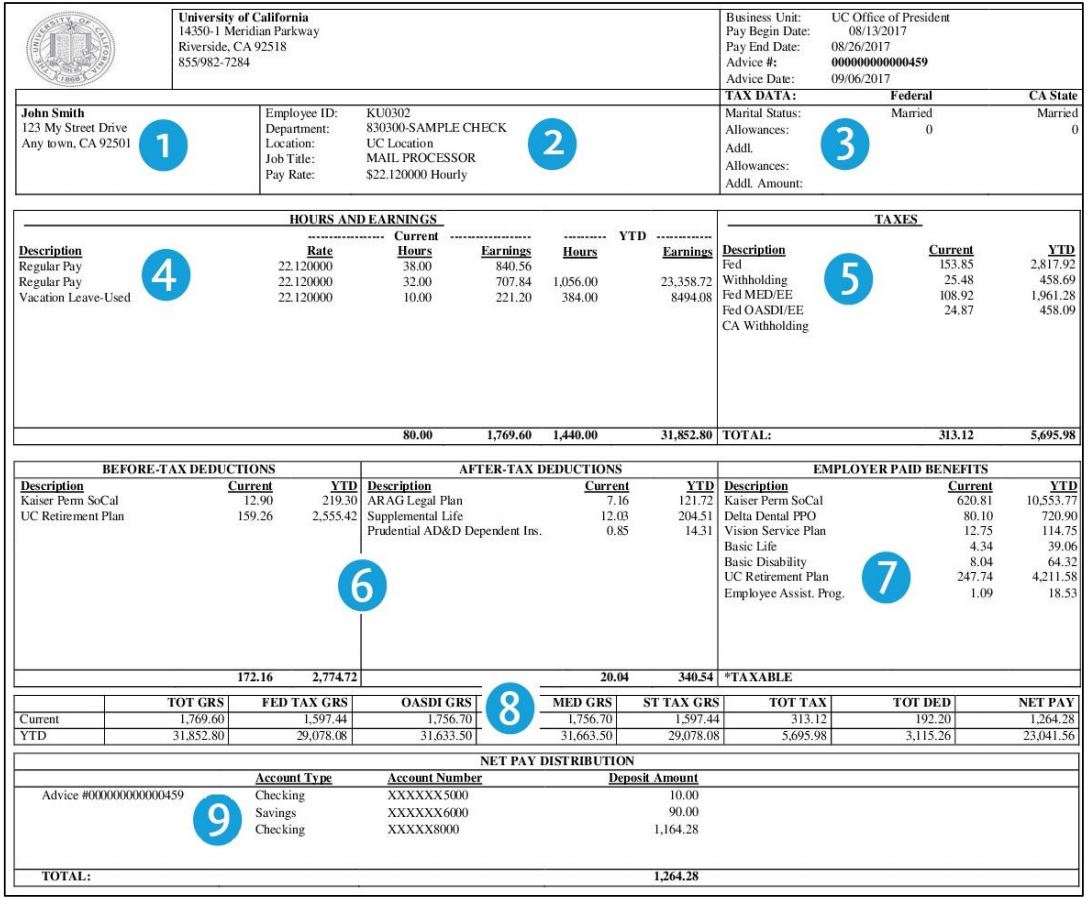

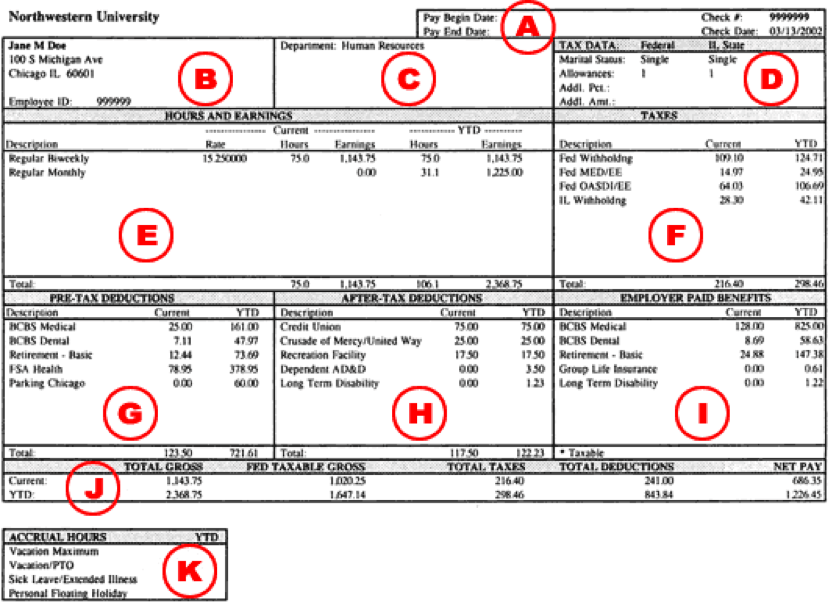

Understanding Your Paycheck Credit Com

Paycheck Calculator Online For Per Pay Period Create W 4

Understanding Your Paycheck

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Tax Information Career Training Usa Interexchange

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

My Paycheck Administrative Services Gateway University At Buffalo

New Paycheck Ucpath

Understanding Your Paycheck Direct Deposit Advice Jmu

Here S How Much Money You Take Home From A 75 000 Salary

Understanding Your Paycheck Human Resources Northwestern University

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age